The U.S. offshore wind industry faces a dramatic shift following the Presidential Memorandum titled "Temporary Withdrawal of All Areas on the Outer Continental Shelf from Offshore Wind Leasing and Review of the Federal Government’s Leasing and Permitting Practices for Wind Projects."

This action fundamentally reshapes the immediate future of the sector. Here’s a breakdown of its impact on the pathway forward:

Halt on New Leasing and Permitting

Effective January 21, 2025, the memorandum withdraws all Outer Continental Shelf (OCS) areas from new or renewed wind energy leasing indefinitely until revoked by a future presidential action.

It also prohibits federal agencies from issuing new permits, approvals, or loans for both onshore and offshore wind projects pending a comprehensive review by the Secretary of the Interior, in consultation with the Attorney General.

What are the immediate implications?

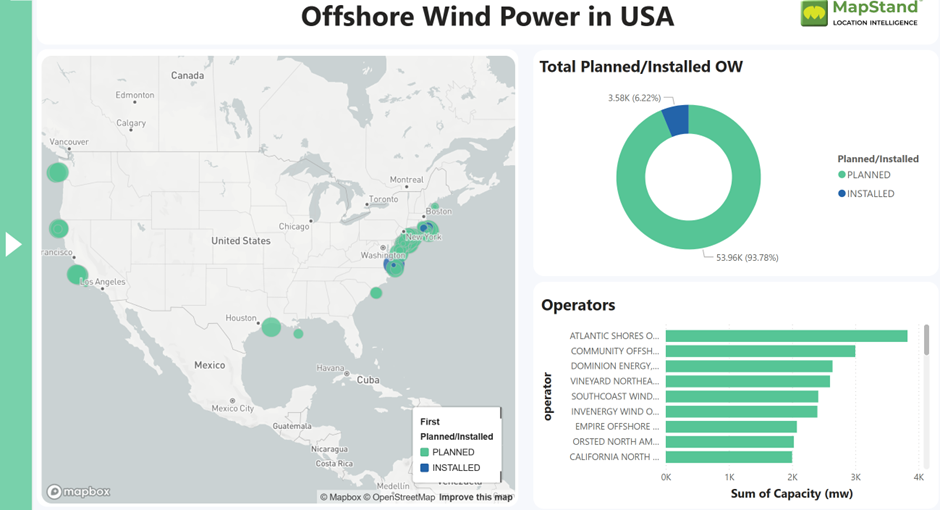

The immediate implication is a significant stalling of projects not yet permitted or leased. Developers are now unable to bid on new OCS areas, and those in the early planning stages face an indefinite and disruptive delay to their timelines and investment plans. As the MapStand BI dashboard below illustrates, over 90% of offshore wind projects currently in the planning phase are heavily jeopardized by this moratorium.

MapStand's BI dashboard portraying offshore wind project phases and operators for USA.

Review of Existing Leases:

The memorandum mandates a review of existing wind energy leases to assess their “ecological, economic, and environmental necessity,” with recommendations for potential termination or amendment. No deadline is specified for this review, creating uncertainty about its duration.

Way Forward: Projects already leased (e.g., those awarded under the Biden administration, like Vineyard Wind or South Fork Wind) may continue if fully permitted and under construction, as the moratorium explicitly targets new or renewed leasing rather than halting ongoing operations. However, leases still needing federal approvals are at risk of delay or cancellation depending on the review’s outcome.

MapStand's cloud mapping environment portraying offshore wind projects' location and statuses on the east coast of the USA, including the existing onshore power grid.

Exemptions and Loopholes

The moratorium applies only to wind energy leasing and permitting, explicitly leaving oil, gas, mineral, and conservation activities unaffected. This suggests a policy tilt toward traditional energy sources.

Potential Reversal:

The moratorium lasts until revoked by a future presidential memorandum, meaning a change in administration or policy could reopen OCS leasing. However, this offers no short-term relief, as Trump’s term extends to at least January 2029.

Current Pathway: The immediate way forward hinges on existing projects with secured leases and permits moving to construction (e.g., Coastal Virginia Offshore Wind, Empire Wind 1), while new projects are effectively frozen. Industry players may lobby for clarity on the review process or seek legal challenges under the Outer Continental Shelf Lands Act (OCSLA) to protect existing investments.

Official Documents Stating the Pathway Forward and Trump Government Policy

As of April 3, 2025, the primary official document is the January 20, 2025, Presidential Memorandum itself, available on the White House website. No additional policy documents have been widely released by the Trump administration detailing a comprehensive offshore wind strategy beyond this moratorium. However, related insights can be inferred from:

Presidential Memorandum (January 20, 2025):

Key Policy Signals: It emphasizes navigational safety, national security, commercial interests (e.g., fishing), and environmental concerns (e.g., marine mammals) as justifications, alongside scepticism about wind’s reliability (“intermittent generation”) and economic value (“subsidies”). This aligns with Trump’s campaign rhetoric of prioritizing fossil fuels and opposing wind energy.

Pathway Indication: The review process suggests a potential overhaul of leasing and permitting, but no concrete alternative pathway for wind is outlined—only a pause and reassessment.

Department of the Interior Actions:

On January 20, 2025, the Department of the Interior issued a broader 60-day suspension of all renewable energy authorizations (onshore and offshore), as noted in some analyses. While this has likely expired by April 3, 2025, it reflects an initial hard stop on wind progress, with the memorandum extending the offshore-specific freeze indefinitely.

Implication: No new Interior Department guidance has emerged post-moratorium to clarify the review’s scope or timeline, leaving the Bureau of Ocean Energy Management (BOEM) in limbo.

Project 2025 (Heritage Foundation):

Though not an official government document, this 900-page policy blueprint, authored by former Trump officials and published in 2024, calls for abandoning offshore wind goals (e.g., Biden’s 30 GW by 2030) and frames wind as detrimental to fisheries and other industries. Trump has distanced himself from it publicly, but its influence on appointees like Doug Burgum (Interior Secretary nominee) could shape policy.

Pathway Hint: If adopted, it suggests a permanent shift away from offshore wind, though no such formal adoption has occurred by April 3, 2025.

Congressional and State Responses:

No new federal legislation or executive orders have been released by April 3, 2025, specifically addressing offshore wind’s future under Trump. States like New York and New Jersey, reliant on wind for climate goals (e.g., 9 GW by 2035 and 11 GW by 2040, respectively), are pushing forward with permitted projects but lack federal support for new leases.Implications for the Industry

Project Delays and Cancellations:

Projects totalling ~30-32 GW (per Aurora Energy Research and Rystad estimates) are at risk, potentially halting power for millions of homes. Companies like Ørsted have already scaled back U.S. ambitions, slashing investment goals by 25% in February 2025 due to uncertainty.

Shift to Alternatives:

Developers may redirect capital to onshore wind (less affected by federal rules) or international markets (e.g., Europe, China), ceding U.S. leadership in offshore wind technology. States may lean harder on natural gas, undermining climate goals.

Investor Uncertainty:

The lack of a review timeline and the potential for lease terminations deter investment. High costs and existing challenges (supply chain issues, interest rates) are compounded by political risk, making offshore wind less competitive.

We predict significant disruptions in the U.S offshore wind industry for the foreseeable future

The January 2025 moratorium has significantly disrupted the U.S. offshore wind industry by halting new leasing and permitting, stalling over 90% of planned projects (approximately 30-32 GW), and driving economic fallout, including job losses (e.g., Vineyard Offshore’s 50 job cuts) and cancelled infrastructure (e.g., Prysmian Group’s factory).

While projects already under construction, such as Vineyard Wind 1 and South Fork Wind, continue, others like Atlantic Shores South are on hold following partnership exits by Shell and EDF Renewables, who wrote off nearly $2 billion.

The policy’s tilt toward fossil fuels, exempting oil and gas activities, may pave the way for alternative energy projects, but shift offshore wind momentum to international markets like Europe and China, threatening U.S. leadership in the sector while developers face indefinite delays and investor uncertainty.