Natural hydrogen has been hitting headlines recently, with Bill Gates-backed Mantle8 reporting evidence of major reserves in the French Pyrenees Mantle8 | French Pyrenees, while explorer Snowfox Discovery has secured significant investment from bp-Ventures and Rio Tinto BP | Snowfox Discovery. National-level exploration frameworks have been established in France, Australia, Canada, South Africa and US - including regulatory guidance for permitting, mapping, surveying, appraisal and resource classification.

Natural hydrogen is emerging as an exciting frontier in the race for affordable and clean hydrogen, with potential to cut carbon emissions by acting as a replacement for grey hydrogen (depending on purity), as well as other use-cases in refining, ammonia production and low carbon fuels. Explorers report potential production costs under €1.00/kg, which in some cases would be more economical than grey hydrogen (produced using natural gas) and significantly below current economic estimates for green hydrogen (€3-8/kg, PwC)

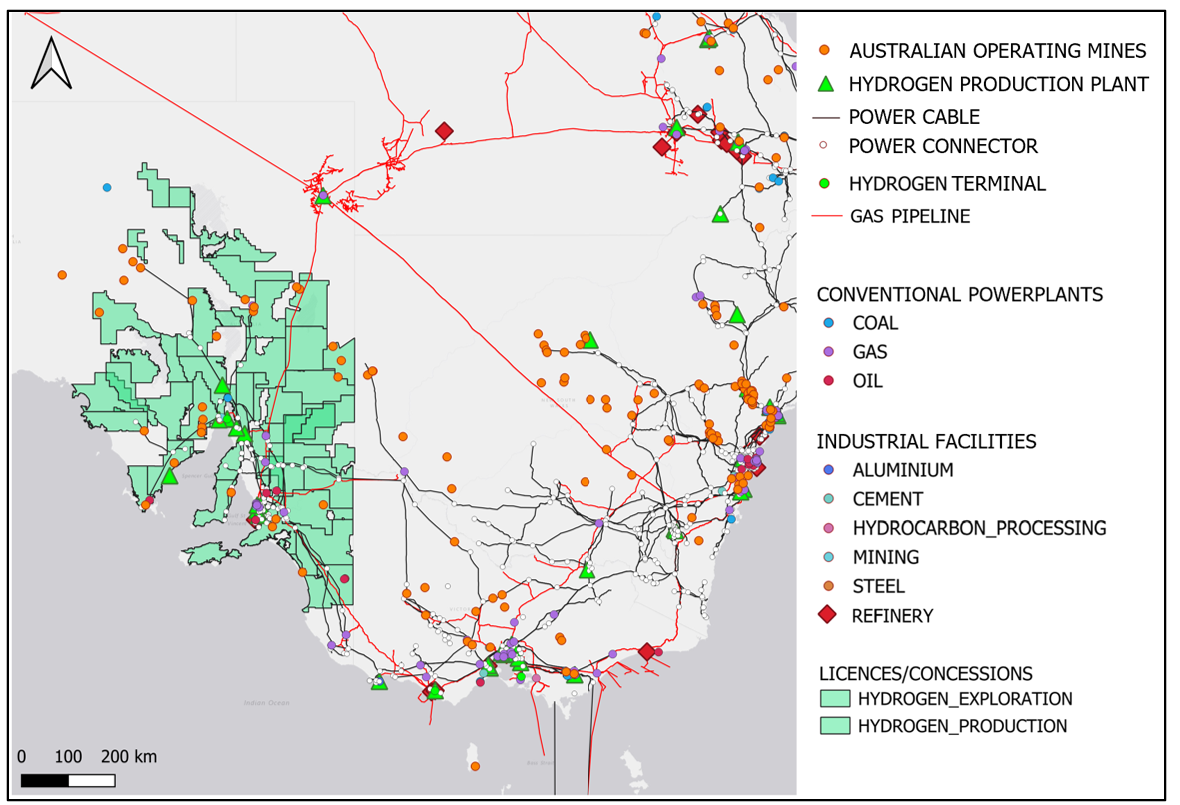

At MapStand, we are tracking these developments closely, combining regulatory licensing, geological surveys, and offtake market data to help our customers evaluate opportunities and navigate uncertainties in this emerging market. Early movers are making headlines, but long-term success depends on seeing the whole picture, from exploration and infrastructure through to offtake opportunities and future demand. MapStand’s spatial data gives explorers a clear, integrated view of the entire hydrogen value chain, helping assess risk, evaluate hubs, and target opportunities.

How MapStand Supports Natural Hydrogen Explorers

- Identify and rank viable hydrogen offtake opportunities close to existing natural hydrogen exploration activity.

- Evaluate transport options (infrastructure) in target areas viable for transporting hydrogen to offtake facilities.

- Benchmark strategy and activities against other hydrogen players and other decarbonisation pathways – e.g. CCUS, electrification.

- Future emissions modelling: Visibility of future CO₂ supply dynamics, helping identify long-term hydrogen fuel switch targets and anticipated shortfalls.

- Automated daily updates - first mover advantage and better decisions.

Ready to get started?

Create an account on our MapStand Community or talk to our experts